Discover Capitalise

Capitalise is a specialist cloud-based tool designed to calculate bespoke Duxbury calculations tailored to your client’s circumstances. Licence subscription per user, per annum.

Create Bespoke Calculations

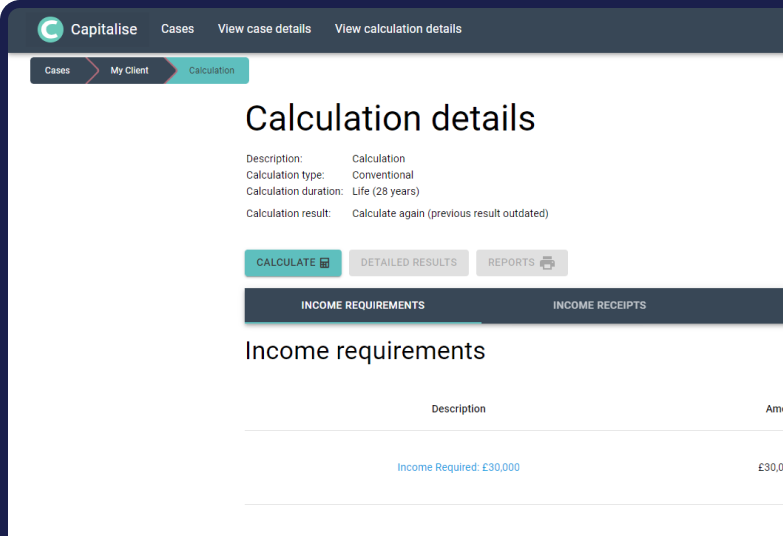

With Capitalise, you can carry out conventional calculations where you work from an income required to a capital sum.

With Capitalise, you can carry out conventional calculations where you work from an income required to a capital sum, or a reverse calculation whereby you work from a capital sum to establish a required income.

- Incorporate income, capital and pensions receipts into your calculation

- Carry out conventional or reverse calculations

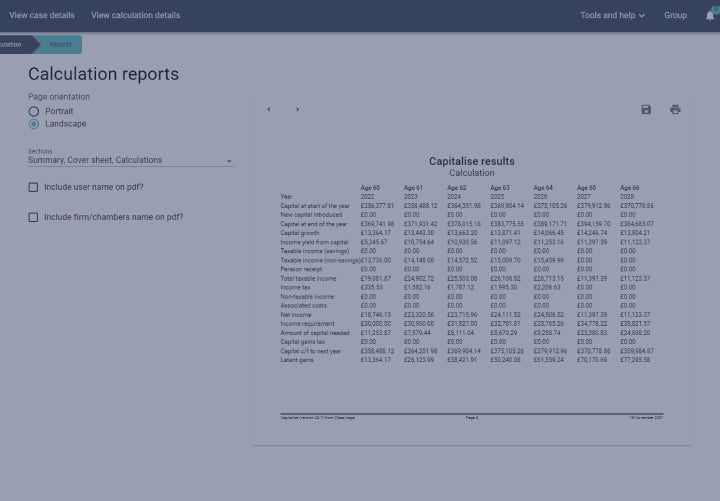

- Create a fully formatted PDF report, broken down year-by-year

High Court Judge, taken from the judgment ND v GDAlthough I acknowledge that there may be the odd case where an expert is required to carry out a very clearly defined and tailored Duxbury calculation, in the vast run of cases it is inappropriate to reach beyond the Duxbury tables in At A Glance, or the Capitalise programme for a more advanced formula.

Filled with tons of great features

Conventional or Reverse

Work from an income required to a capital sum or work out the income a specific capital sum will provide.

Limitless calculations

No limit to how many calculations you create for each client

Adjustable variables

Adjust variables such as inflation, income yield and capital growth, income tax and allowances, capital gains tax and state pension

Set your duration

Calculations can be for life or a specified period

Tailor your result

Reduce, or enhance the income requirement at a certain point during the term

Fully formatted report

Reports include the calculation result, a summary page, and a detailed breakdown for each year of the calculation. Import your results to Excel or download as a PDF.

Access anywhere

Capitalise is cloud-based and can access through your web browser, at home or in the office.

Preserve your clients capital

Ensure the initial capital is preserved at the end of the term, so it falls into the recipients estate.

Additional security documentation

Captialise - IT FAQs

549.25 kB

Capitalise - Technical Requirements

76.99 kB

High Court Judge, taken from the judgment ND v GDOften during a hearing, as issues crystallise, the judge will ask for specific calculations to be carried out; indeed, I did just that in this case. The underlying assumptions can be adjusted on the Capitalise programme if required.

Explore Capitalise FAQ’s

How much is Capitalise?

Capitalise is £320 (+VAT) per user, per year. A subscription is required for each user accessing the software. Licences are per user, per annum. You will be contacted shortly before your licence expires to confirm renewal. We are not able to refund licence costs part way through the subscription period.

How long does a free trial of Capitalise last?

A free trial of Capitalise lasts for 1 week.

How often does the software update?

Capitalise is updated at the start of every new financial year, taking into account any new tax and NI rates & thresholds. This update is automatic.

How does the subscription work?

A licence subscription to Capitalise is charged per user, per annum. You will be contacted shortly before the expiry of your licence to confirm that you wish to renew. We are not able to refund licence costs part way through the subscription period.

Can I book a demo of Capitalise?

Yes. We offer free demos of Capitalise with our friendly training staff. Complete the ‘Book a Software Demo’ form using the button above. If you have any specific topics you’d like the demo to cover, please include these in your request.

Do I need to download Capitalise?

No, Capitalise is cloud-based and can be accessed through your web browser. There is no need to download the software.

Is my data secure?

Yes, users will login with an email address, password and two factor authentication. Also, all data entered into our programs is encrypted.

Does Capitalise work on mobile or tablet devices?

Yes, you can access Capitalise on your mobile phone or tablet. Capitalise is accessed through your web browser. For the best user experience, we recommend accessing Capitalise on your laptop or desktop.